Showing: 26 items

Refine By

April 01, 2024 | by Diebold Nixdorf

Explore case studies and learn how your peers leverage Diebold Nixdorf banking products and services for their success.

May 30, 2022 | by Diebold Nixdorf

With customers expecting more every day, financial institutions need to ensure their current platform offering provides the meaningful customer experience modern consumers expect; this is where product experience (PX) becomes critical.

February 14, 2022 | by Nirantak Kumar

From cardless transactions to interactive video teller, advanced marketing at the ATM and more, you need to think strategically about your branch transformation and digital strategies, so you have an answer to the pivotal channel-choice question.

September 20, 2021 | by Diebold Nixdorf

Learn how bank99 partnered with Diebold Nixdorf to deliver ATM-as-a-Service solution in just three months.

August 16, 2021 | by Diebold Nixdorf

Learn about Calvin B. Taylor bank is attracting customers with a flexible, interactive experience.

May 03, 2021 | by Ludwig Simoen

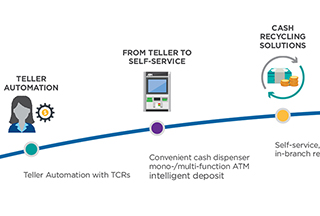

In a cash recycling scenario, your own consumers are replenishing your ATMs for free. Are you taking advantage of it?

April 26, 2021 | by Diebold Nixdorf

The first step in laying the foundation for success is continually reassessing and evolving current strategies to determine if you are conducting business effectively. FIs should focus on streamlining processes or possibly even outsourcing tasks to drive efficiencies.

March 25, 2021 | by Diebold Nixdorf

Find out how Diebold Nixdorf can modernize your physical branch designs for the future of retail banking.

October 12, 2020 | by Octavio Marquez

From updated ATMs, to mobile apps, to virtual bank tellers, FIs are adopting new tools and technologies to drive innovation as they welcome customers back to newly-enhanced physical branches. This blog explores three of the emerging capabilities that may define the future of the physical bank branch.

September 30, 2020 | by Diebold Nixdorf

Diebold Nixdorf Advisory Services is a team of experienced banking professionals who can help you develop and implement channel transformation initiatives for your institution, including technology.

September 28, 2020 | by Scott Weston

Merely having a deposit-accepting ATM is no longer the most efficient, convenient or fulfilling option for transaction migration. It simply isn’t a good experience for consumers or branch employees, and the cost to FIs for balancing is cumbersome. Deposit Automation technology creates the best overall experience and efficiency for migrating transactions out of the branch… especially with the acceleration of our dependence on self-service through COVID.